About Us

Benefits of Using MFAC

We believe that the following features distinguish us from other service providers:

-

Fund-Specific Experience

The scope of our firm’s experience and expertise, specifically in the fund business, is quite extensive. The depth of the background of the over 25-year average experience of our principal and senior professionals qualifies us as experts in every facet of the mutual fund business.

-

Boutique Client Services

Our business model limits the number of clients we will accept so that each of our clients can expect to receive value added services at extremely competitive rates without fear of dilution of service levels.

-

Surrogate Back Office

We are an independent third party administrator who truly functions as your surrogate back office. As a result, your in-house staffing requirements will be minimal. We assume the role of “quarterback” with respect to all fund operations which enables our clients to focus on marketing and investment management.

-

Customization of Services

We have the unique ability to design our administrative services to meet the specific needs of each client. Our size and structure allows us to 1) customize our administrative services to focus on the areas that are important to the client, and 2) offer our services at an extremely competitive rate.

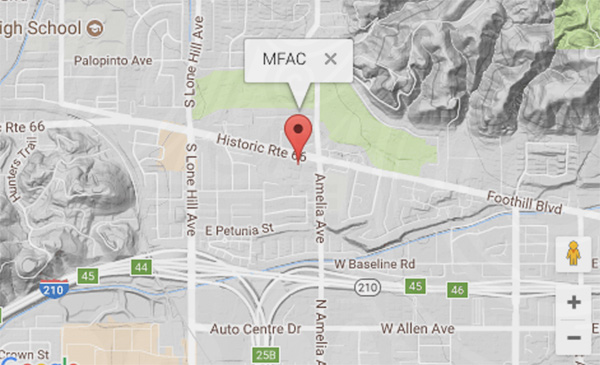

Mutual Fund Administration, LLC (“MFAC”) was established in 2007 by a team of experienced professionals with a long history of providing third party fund administration services. MFAC provides practical and objective guidance for the creation of mutual funds as well as the day-to-day administration of mutual funds.

We work with investment advisors at a wide variety of levels and, as appropriate, with legal counsel, chief compliance officers and other professional service resources. Our services can be broadly defined as fund formation, fund governance, and fund administration services. Our stated objective is to provide highly personalized, cost effective, value-added services to our select investment advisors, and ultimately the shareholders of their funds.

Fund Formations

We manage fund formations to ensure a fund's regulatory, compliance, tax and operational requirements are fully satisfied. We manage the start-up process from beginning-to-end.

- Draft and file registration statements with SEC

- Prepare agreements and plans (i.e. Advisory Agreements, Rule 12b-1 Plan)

- Coordinate 15(c) process with Board

- Provide guidance on operational matters such fund name, fiscal year end

- Prepare fund operating expense projections

- Obtain cusip, ticker and IRS tax identification number

- Register fund with industry tracking organizations (Lipper, ICI, Morningstar)

Fund Governance

We help establish the governance framework and continue to ensure proper implementation. We work closely with the board of trustees to ensure that a fund is operating in the best interests of its shareholders.

- Coordinate the Trust’s Board of Trustees’ (Trustees) communication

- Establish meeting agendas

- Compile Board meeting materials

- Evaluate independent auditor

- Secure and monitor fidelity bond and Director and Officer Liability coverage

- Prepare minutes of meetings of the Board of Trustees and Fund shareholders

- Provide personnel to serve as officers of the Trust if so elected by the Board of Trustees, attend Board of Trustees meetings and present materials for Trustees’ review at such meetings

Fund Administration

We provide expert regulatory and financial administration support during the fund creation and for ongoing operations. Our professionals work as your back office “quarterback” to ensure fund compliance with federal securities laws and minimize costly reliance on outside counsel.

- Monitor compliance with the 1940 Act requirements and Subchapter M

- Monitor compliance with the policies and investment limitations as set forth in the prospectus and statement of additional information

- Blue sky compliance- prepare and file with the appropriate state securities authorities

- Prepare annual updates to the Prospectus and SAI

- Prepare proxy statements (when needed) and spearhead process

- Prepare annual and semi-annual reports and related SEC filings

- Coordinate the printing, filing and mailing of publicly disseminated Prospectuses and shareholder reports

- Coordinate filing Form N-PX (proxy voting)

- Calculate required distributions (including excise tax distributions)

- Monitor arrangements under shareholder services or similar plans

- Manage fund expense forecasts and budgets

- Monitor expenses and manage accruals

- Initiate fund expense payments

- Assist in overall operations of the Fund